You can also follow my blog via Substack, where I also publish these same posts.

I Tested Anthropic's Newly Released Wealth Management Plugin

I dug into Anthropic's launch of Claude Skill wealth management plugins this week. I ran them against a typical imaginary couple's financial plan to assess its usefulness. Here are my takeaways...

Wait, you’re telling me there’s a way to avoid capital gains taxes?? 🧐

They say the only things certain in life are death and taxes, right? Well, that might not quite be right. A new tax strategy has been emerging due to improved technology, reduced trading costs, and the use of statistical probabilities. It's complex, but in my new article, I try to demystify why and how it works. The bottom line is this: What if it were possible for regular people to grow a long-term portfolio that tracks an industry benchmark like the S&P 500, yet make retirement withdrawals for living expenses without paying capital gains taxes? Does that sound like alchemy? Read more in my introduction to long-short direct indexing.

Navigating Tech Industry Layoffs

I wrote another long form article on what I'm hearing from clients and seeing in the tech industry right now. The balance of power has shifted towards employers for reasons I covered in my last article. This article talks about to tilt it back in your favor.

The "Lottery Ticket" Illusion: Why Picking Winners is Harder Than You Think

I wrote this article to present the case against holding individual stocks. It's not a moral imperative, but a rational guideline based on the statistical evidence over long periods of time. I know there's a strong intuitive sense to continue holding individual stocks that have done well. It's not easy to argue against 10 million years of evolutionary biology embedded in our amygdalas. I only ask that you consider the risks and maybe balance out the lottery tickets with your other, more diversified investments.

The "Great Unbossing": A Financial Planner's View on Why Tech Middle Managers Are Bearing the Brunt of Late 2025 Layoffs

I wrote an article on what I'm hearing from my financial planning clients in the tech sector about growing layoffs, performance ranking pressure, and work stress. I suspect this will resonate with many, and I'm curious to hear your thoughts. I get a lot of unvarnished feedback from clients, and I'm seeing consistent underlying trends.

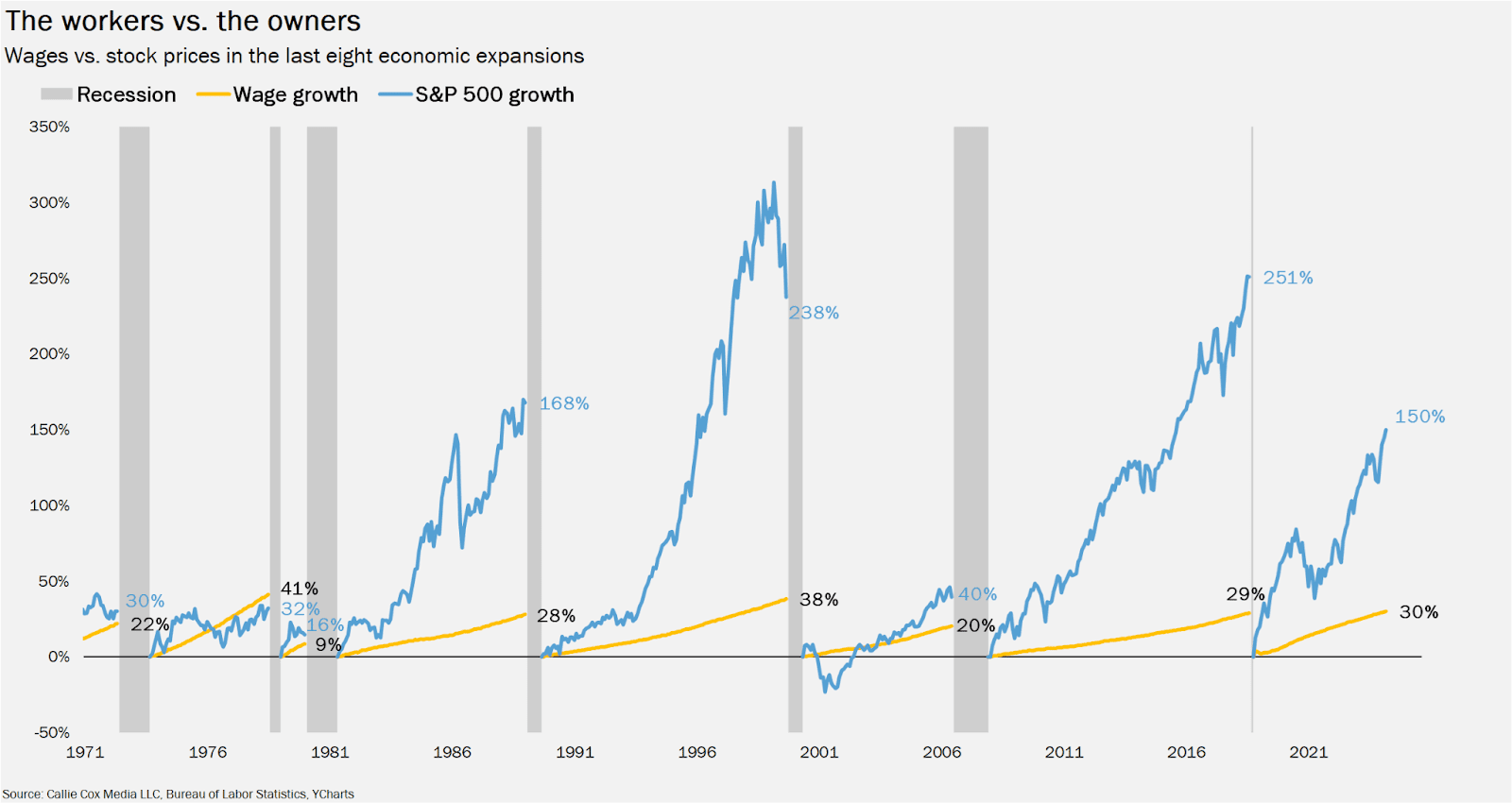

Building Wealth Has Changed

Building wealth used to be a lot easier by simply working hard and earning a good paycheck. These days, that’s very difficult to do. Everything is more expensive. The only way to get ahead is to start investing early and let the growth compound over time.

Should we be pausing investing right now?

Is the market going to tank tomorrow? How about next month? Should we pause investing for a while? Here's what the long-term research says.

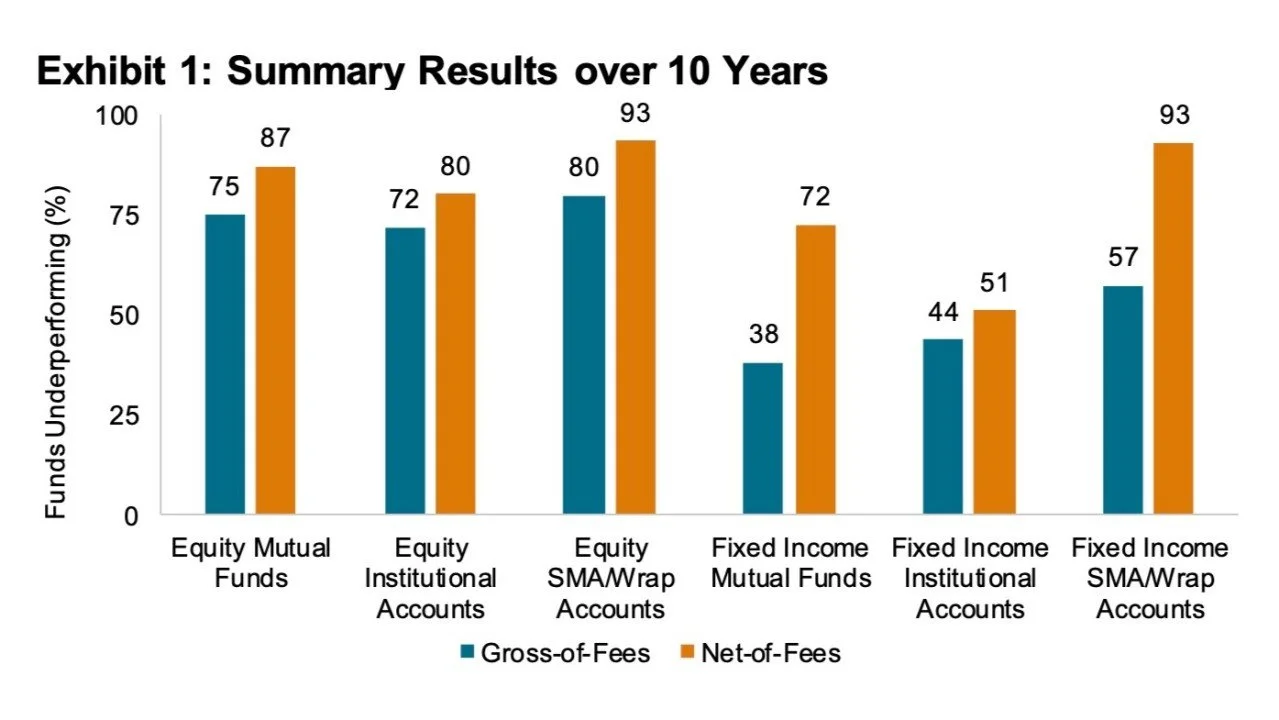

Why Passive Investing Still Outperforms: Lessons from the 2024 SPIVA Institutional Scorecard

SPIVA just published its annual analysis of active vs. passive investing. It never disappoints and this year is no exception. Maybe the dumb money isn't so dumb after all.

Open Enrollment at F5

It's Open Enrollment Week at F5. Here are my insights into what changed since last year, and how to decide between the medical insurance options. For F5 employees, it's an important decision to make!

A Good Analogy is Worth a Thousand Words

I love a good analogy. Several great ones about the stock market have lived rent-free in my brain for decades. In the coming weeks, I'll share some of them. They may be helpful to you as we enter a season of higher market volatility.

It's Time for Some Equanimity

If you've been watching the stock market, then you know it's time for equanimity. We all know we're supposed to sit tight and hold on. I agree! But there are a few things you should be doing right now, depending on your situation. See my article for more.

Evaluating the F5 401(k) Investment Options

F5 Employees - did you get Fidelity's latest F5 401(k) brochure? I read through it and graded all the investment options listed. Some are gems. Some are 💩. Read on...

Dealing with the Emotions of Stock Losses

We're undergoing a "market correction," and that's never fun. My latest article addresses the emotions of watching a portfolio shrink day by day 😧

Help! Most of My Net Worth is Tied Up in Employer Stock!

Many of you are holding most of your net worth in employer RSUs. That's a precarious place to be right now.

Seven Signs of a Successful DIY Investor

After 25 years of DIY retirement planning for myself and now advising others, I've formed some opinions about how to do it right. Whether you're a passionate self-directed investor or someone who'd rather spend their weekends elsewhere, this honest analysis might help you make one of the most critical decisions possible about your retirement plan. I'd love to hear what you think!

Selling F5 RSU & ESPP Shares

I took my analysis even further this time, looking at the last 10 years of F5 RSU and ESPP sale periods. The historical data shows that waiting a few days to sell opened up gains of $1,000-$2,000/year for typical F5 employees, and more for higher-earners. Read on for the details...

The Stock Market & Elections

Today's the day! Sharing the more interesting charts I've seen about how the market historically reacts to Presidential Elections 🇺🇸

A New Chapter

Hey everyone, I wrote a brief article about my decision to move on from tech and try something new. I'd love to hear your thoughts - thanks for being a part of my journey!