Why Passive Investing Still Outperforms: Lessons from the 2024 SPIVA Institutional Scorecard

Percentage of Funds that Underperformed their Respective Benchmarks

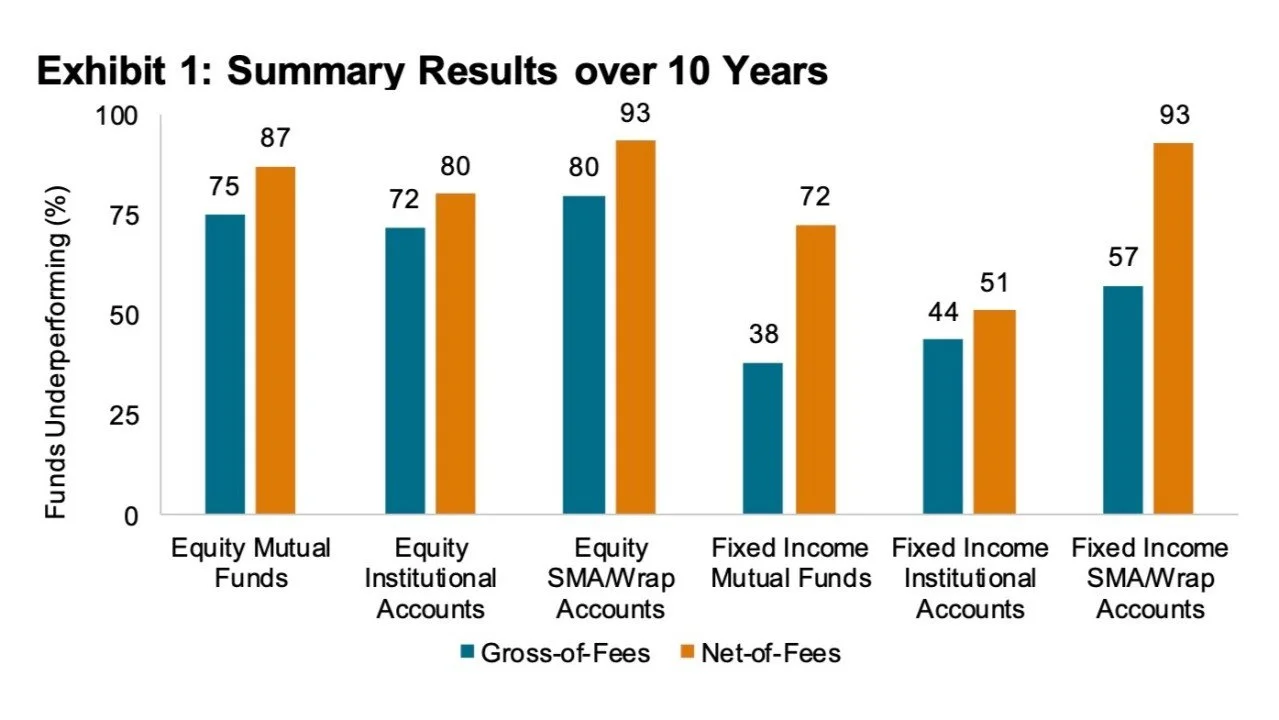

There's a pervasive feeling that investment professionals—the institutions with billions under management—can beat the market. I mean, wouldn't you expect that? They're being paid to do something right? They're more intelligent than the rest of us, right? Well, the latest SPIVA Institutional Scorecard puts that to the test, and the 2024 results remain remarkably consistent: most active managers—retail or institutional—fail to outperform their benchmarks.

The Data Speaks

SPIVA stands for "S&P Indices versus Active" and it's part of the S&P Global organization. They've been publishing active vs. passive scorecards for many years. In the latest report, which just came out, over the 10-year period ending December 2024, 87% of equity mutual funds underperformed their benchmarks. In bonds, the story was only slightly better, with more than half of funds lagging their benchmarks. Every year, just enough active managers beat the market to keep hopes up (in 2024 roughly ⅓ of them), but the problem is that very few seem to be able to do it consistently, year after year.

Consider large-cap U.S. equity—the most closely watched category. The Scorecard found that 84% of mutual funds underperformed the S&P 500 over 10 years(69% in 2024 alone). Institutional accounts did no better, with nearly 85% underperforming as well. (e.g. billion-dollar pension funds and endowments)

Why This Matters for Small Investors

If billion-dollar institutions with armies of analysts and access to every tool imaginable can’t consistently beat the market, what does that mean for the rest of us? It reinforces what decades of research and experience have shown: markets are highly efficient, and trying to outguess them is a losing game over time.

Passive investing, through broad-based, low-cost index funds, eliminates the guesswork. It reliably captures market returns, without the drag of high fees or the risk of betting on managers who rarely sustain outperformance.

The Bottom Line

The 2024 SPIVA Institutional Scorecard is yet another reminder that, whether you’re a small retail investor or a massive institution, the odds are stacked against you when choosing active management. Instead of chasing elusive alpha, focus on what you can control: diversification, holding discipline, tax reduction and cost minimization.

That’s the power of passive investing—and it’s why I continue to recommend it as the cornerstone of a sound financial plan.

Disclaimer: The information provided in this blog post is for educational and informational purposes only and does not constitute specific financial, tax, or legal advice. All investing involves risk, including the potential loss of principal. Market data and statistics cited are believed to be accurate as of the date of publication, but are subject to change. Please consult with a qualified financial professional to discuss your individual circumstances and risk tolerance before making any investment decisions.