Evaluating the F5 401(k) Investment Options

I got this in the mail last week. If you work for F5, you probably did too.

Fidelity recently mailed me a physical copy of the Investment Options Guide for the F5 401(k) plan in NetBenefits.

The brochure outlines 38 investment options in F5’s 401(k) NetBenefits plan. Some of the investments are solid, while others are, pardon my French, 💩. In this brief write-up, I’ll explain which are which and why. Over the last 20 years, I’ve accumulated a healthy chunk in my F5 401(k), so the investment options matter to me and should to you too.

First, it’s important to note that designing the optimal retirement investment portfolio is both a science and an art. Timing, risk tolerance, tax situations, and personal beliefs must all be considered. However, there’s a rational way that many advisors rely on: all major mutual fund companies publish their own model portfolios, which serve as secular, impartial templates that are mathematically ideal but can be tweaked and optimized for an individual’s situation.

As an advisor, I've gotten access to these models, and discussed them with the construction teams. I’ve primarily leaned on Vanguard’s models because I trust their core investing philosophy: match the market’s performance at the lowest possible cost, at whatever risk level you choose. They have an entire research team dedicated to designing and maintaining these models, employing a conservative, Nobel Prize-winning research-based approach that avoids many mistakes associated with trying to “beat the market.” If you’re a fan of the efficient market hypothesis, John Bogle, or “A Random Walk Down Wall Street,” you’ll appreciate them.

After talking to the people who design these model portfolios, one interesting observation is that complexity does not necessarily correlate with value. It’s possible to create very sophisticated portfolios for almost any risk tolerance level by mixing, in various proportions, four atomic parts: US stocks, non-US stocks, US bonds, and non-US bonds. In doing so, you’ll own a piece of almost every major company and government on earth. And these portfolio models are appropriate for centi-millionaires or even billionaires. John Bogle was famous for saying:

"Don't look for the needle in the haystack. Just buy the haystack!"

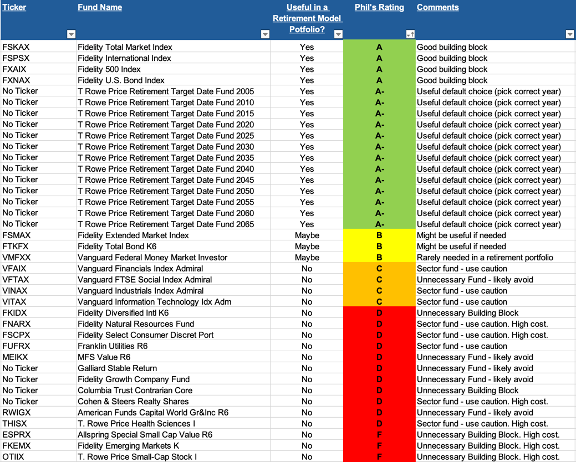

Grading the Options, A through F.

Therefore, the lens through which I chose to grade F5’s 401(k) investment options is the extent to which the individual investment option meets the following two criteria:

Criteria 1. It serves an essential diversification role in a well-rounded retirement portfolio. If it doesn’t, research indicates that you don’t need that fund to create a successful, optimized retirement portfolio.

Criteria 2. Its fees are in the lowest decile (10%) compared to similar mutual funds. If they aren’t, we should consider exploring cheaper ways to access a similar investment for our retirement portfolios.

My overall observations are:

1. F5’s 401(k) plan is good enough for almost everyone. It has nearly all the essential components for a low-cost retirement portfolio, except for an international bond fund, which I see as a significant gap considering the other dozen unnecessary funds.

2. Unless there’s a plan to custom-design a portfolio, the average person should probably opt for one of the thirteen T. Rowe Price target date funds. They’re somewhat pricey but not too terrible ($37 per year for every $10k invested). And they're proven effective.

3. Four key building block funds get A ratings 🏆 —FXNAX, FXAIX, FSKAX, and FSPSX—are low-cost, intelligent choices from which you can build almost any efficient portfolio. Think of them as the sub-atomic particles necessary to build almost anything.

4. There are eleven expensive funds that I don't think serve any useful purpose in a balanced retirement portfolio, so I give them a “D” grade 👎🏼. These are sector funds where you’re simply betting that you know something the rest of the world doesn’t and expecting to profit off that information. Good luck with that. It may work in the short term, but retirement portfolios are supposed to be designed with the long term in mind.

5. I give “F” grades to three funds 💩. There’s unlikely to be a very good reason to own them. They are expensive, actively managed funds that don’t clearly contribute to a balanced retirement portfolio given the existence of the aforementioned sub-atomic particles.

Morningstar is a rating agency that rates all these funds on a Gold, Silver, Bronze, or No-rating scale. I used their ratings to inform my own ratings. To be blunt, I would avoid anything bronze or unrated. A Morningstar bronze rating is the modern equivalent of a participation ribbon. That leaves us with Gold and Silver funds. Fortunately, all four core building blocks have gold or silver ratings. They shine like bright stars in a dark sky.

If you're a finance nerd, you can access my spreadsheet here.

My rating of the various investment options in F5's 401(k)

My rating of the various investment options in F5's 401(k)

If you're wondering what you could or should change in your portfolio, I’ve been using a tool from Nitrogen called Riskalyze to analyze and design portfolios for my current clients. It’s beautiful in its elegance and sophistication. If you’re wondering how your portfolio measures up and would like a free portfolio analysis, you can take the five-minute risk-tolerance score questionnaire for free. Doing so will notify me, and if you want, I can help interpret what that score means and tell you what your current portfolio risk score is in comparison. You may choose to fix any gaps yourself or have me do it, but either way, I bet you'll benefit.

Now go and invest wisely!

Disclaimer: The information provided in this blog post is for educational and informational purposes only and does not constitute specific financial, tax, or legal advice. All investing involves risk, including the potential loss of principal. Market data and statistics cited are believed to be accurate as of the date of publication, but are subject to change. Please consult with a qualified financial professional to discuss your individual circumstances and risk tolerance before making any investment decisions.