Help! Most of My Net Worth is Tied Up in Employer Stock!

The stock market is two years into a bull rally led almost entirely by tech stocks and has nearly doubled. Many of you own vested and highly appreciated RSU, ESPP, and Option shares in companies that have greatly appreciated. My last email newsletter uncovered a common question: "I have a bunch of employer shares that have increased in value. Should I sell them now? What are my options?”

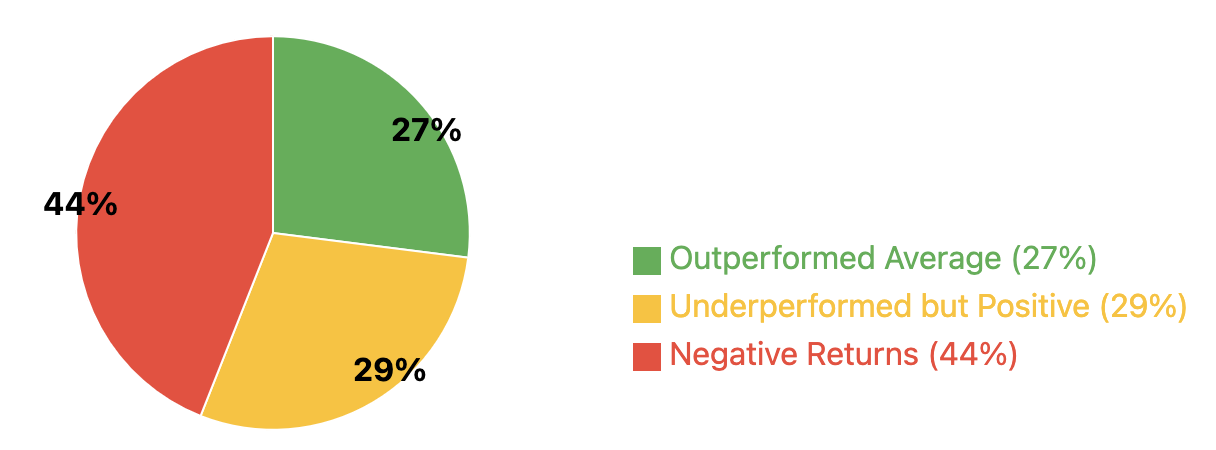

The fear is real because only 27% of stocks in the Nasdaq-100 beat the average between 2001-2023 (most major tech stocks are in the NASDAQ). The rest underperformed. Will your company continue to be one of the outperformers for the next decade? Maybe, but the odds are stacked against it.

Individual stocks in the NASDAQ-100 compared to the NASDAQ-100 average (2001-2023)

Generally speaking, you can determine what to do if you have the answers to these seven questions:

1. How urgent is your desire to diversify? Is it keeping you awake at night?

2. How confident are you that this stock will appreciate in the coming years?

3. What percent of your net worth is tied up in this single stock? More than 20%?

4. How much capital gains have you accumulated in these shares? More than $250K?

5. How much could you sell while remaining below the 20% long-term capital gains tax rate?

6. Are you subject to the 3.8% Net Investment Income tax? (Hint: you probably are)

7. Do you need this money soon, or is it for long-term retirement investing?

Ultimately, you have five options:

1. Sell and diversify. Pay the taxes now. Be thankful for what you got.

2. Harvest tax losses gradually using Custom Indexing. This is effective, but it could take years to produce enough losses to harvest all your company stock gains.

3. Donate the shares to charity via a donor-advised fund (good for the world).

4. Purchase short-term portfolio insurance via derivatives (not a long-term solution).

5. Use an Exchange Fund.

An Exchange Fund can be one of the most effective solutions for significant stock holdings if you don't like the other 4 options. Here’s how it works: various investors pool their shares, via a third party, into a fund. The provider we use closes in monthly rounds, so we put you into a pool during these specific times. A minimum investment of $100,000 is required, and each participant commits to staying invested for seven years. There's a participation fee, but it operates on a sliding scale that starts at 1% per year and decreases as the investment increases.

The pool is designed to approximate the NASDAQ-100 or the CRSP US Large Cap Growth Index. You receive a pro-rata share of the fund in exchange for your stock. No taxes are triggered upon contribution or redemption. There is a real value to this because, mathematically, delaying taxes allows your portfolio to grow faster, resulting in an overall larger after-tax value. After seven years, you now own a diversified basket of stocks. Your cost basis stays the same, and you don’t have to pay taxes until you eventually decide to sell the various stocks in that basket.

So, in summary, the benefits are:

1. You de-risked yourself from single-company stock.

2. You didn’t pay any capital gains taxes.

Thousands of tech employees are already doing this. If you’re interested, let's discuss whether it might make sense for you. For more details, you can read this whitepaper.

Disclaimer: The information provided in this blog post is for educational and informational purposes only and does not constitute specific financial, tax, or legal advice. All investing involves risk, including the potential loss of principal. Market data and statistics cited are believed to be accurate as of the date of publication, but are subject to change. Please consult with a qualified financial professional to discuss your individual circumstances and risk tolerance before making any investment decisions.