The "Great Unbossing": A Financial Planner's View on Why Tech Middle Managers Are Bearing the Brunt of Late 2025 Layoffs

As a financial planner who works primarily with professionals in the technology sector, my daily conversations often serve as a barometer for the industry's health. Lately, the signals have been concerning. I'm hearing increasing firsthand accounts of internal restructuring and organizations "flattening" their hierarchies. More painfully, I have walked with several clients over the last few months who have unexpectedly found themselves on the wrong side of a layoff notice.

This isn't just abstract economic data to me; it affects the financial lives and futures of the people I serve. To better understand the headwinds my clients are facing—and to help those looking for work navigate this new reality—I dug into some recent economic reports that illustrate what's going on. While not everyone is experiencing the same thing, there are some underlying trends going on.

The Current Situation: A "November Shock"

For much of 2025, the narrative was that the worst of the "tech recession" was behind us. However, late Q4 has delivered a stinging reality check. According to the December report from outplacement firm Challenger, Gray & Christmas, U.S. employers announced 153,536 tech sector job cuts in 2025—a 17% increase from the same time last year.

The technology sector is seeing its highest layoff activity since the initial post-pandemic corrections, with November’s numbers signaling that companies are essentially "clearing the decks" before 2026.

The Hidden Driver: "Efficiency" is Code for Earnings Growth

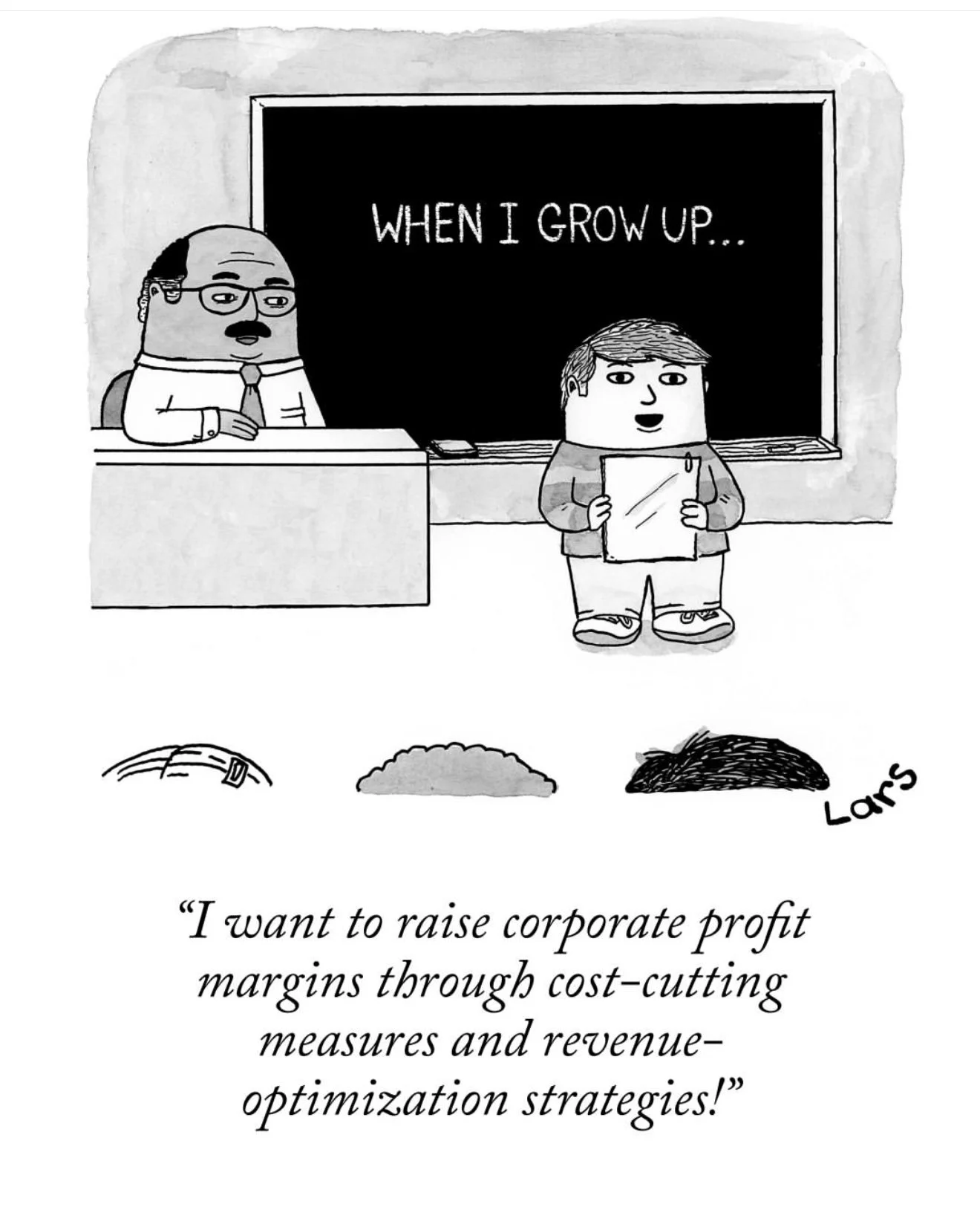

Why is this happening now, when the broader economy seems stable? The answer lies in a fundamental shift in how tech companies are valued. We have moved from an era of "Growth at All Costs" to an era of "Profit-Per-Employee" and "Revenue-per-Employee". The layoffs we are seeing in late 2025 are not necessarily about survival; they are about financial engineering.

1. Decoupling Headcount from Revenue

Historically, if a tech company’s revenue grew, its headcount grew. That link has been broken. Companies are now proving to Wall Street that they can increase revenue while shrinking their staff, or at least holding steady. This increases operating margins and, by extension, Earnings Per Share (EPS)—the primary metric that drives stock prices. Sam Ro, a market commentator I respect, writes "stock market truth #5 is that any long-term move in a stock can ultimately be explained by the underlying company’s earnings, expectations for earnings, and uncertainty about those expectations for earnings. News about the economy or policy moves markets to the degree they are expected to impact earnings. Earnings (a.k.a. profits) are why you invest in companies."

A recent analysis by Simply Wall St (November 2025) highlighted a "concentrated wave" of stock buybacks in the tech sector, noting that the top S&P 500 companies are using cash saved from operational cuts to buy back their own shares. This creates a cycle where layoffs fuel buybacks, which in turn boosts EPS, rewarding executives and shareholders while squeezing the workforce. This is to a large extent what has driven the stock market in 2025.

2. Revenue Per Employee is the new metric all the cool kids are using

The metric of the moment is Revenue Per Employee (RPE). Boards are looking at outliers like Nvidia, which generates roughly $4.4 million per employee, and asking their own CEOs why they are carrying so much "bloat." One blog calls out the ultimate purpose of leveraging AI: "The goal is to uncouple revenue growth and employee headcount growth."

This comparison is driving the "unbossing" trend. CEOs are realizing that to compete with these efficiency metrics, they cannot afford layers of "coordinators" who manage information flow but do not produce revenue directly. They are trading middle management salaries for AI infrastructure, betting that automation will allow them to maintain high earnings with fewer humans on the payroll. The extent to which that pans out remains TBD, and is certainly not infinite. There is a limit to how high RPE can go, but most CEOs feel there is room to grow. Inevitably, companies won't know what that limit is until they've crossed it and hit the wall.

The Mechanism: How "Unbossing" Flattens the Curve

To achieve these RPE targets, companies are targeting specific layers of the organization.

Flattening the Hierarchy: Major players like Meta and Amazon set the tone earlier in the year, and the philosophy has trickled down to the wider Fortune 500. Tech CEOs love nothing more than to copy each other, under pressure from their boards, who are hearing from their buddies on different boards. The RPE goal is currently being achieved not by narrowing focus but by increasing the "span of control"—the average ratio of employees-to-managers. By removing Director and VP layers, companies reduce salary expenses and jack up RPE.

The "Player-Coach" Mandate: The era of the "pure manager"—someone whose primary responsibilities are status reporting and resource allocation—is over—at least for now, though it may come back later once, as usual, the tech industry is done overcorrecting. Today, tech employers are demanding managers, directors and VPs who can manage a team and still commit code, configure a CRM, or close a deal. If a manager cannot step in and do the work of their direct reports, they are viewed as expensive overhead that drags down the RPE metric. This is critical to understand. When your boss sits you down and says something like "we'd like to see more impact from you", this is what they're talking about. They're saying "I'm considering how your impact on revenue ranks against your peers".

AI as the New Administrator: All of this hinges on the hope that AI will be able to automate the very tasks that once filled a middle manager's day. Analysts have predicted that AI will help "flatten organizational structures," making the coordination layer redundant. While I'm a big believer in AI, I get the feeling, though I don't have the data to back this up yet, that a large portion of the increase in productivity is coming, not from AI, but from employees operating under greater pressure and fear. CEOs are happily chalking this up in their earnings reports to "AI leverage," but the reality is that it's coming off the sweating brows of stressed-out employees who are simply doing 20% more work for the same price.

The Human Cost: Survivor’s Guilt and the "Bottom 10%" Panic

While the stock market rewards this RPE and EPS "efficiency," the internal reality for employees is starkly different. The data and anecdotal evidence from my own practice paint a picture of a workforce under siege. Even for those who escape the layoffs, the "prize" is often a heavier workload and a culture of fear. We are seeing a resurgence of what feels like the old "Stack Ranking" systems, where the bottom 10% of performers are routinely culled. And the systems for correctly identifying the bottom 10% are weak and untested. I've seen people laid off that really surprised me - they were most definitely not in the bottom 10%. I've also been hearing more "rehiring of mistaken layoffs" where a key employee was quickly rehired once leadership realized they'd made a colossal mistake.

The "Do More With Less" Trap: As teams shrink, the workload does not. The remaining employees are expected to absorb the responsibilities of their laid-off colleagues. This creates a pressure cooker environment where every employee must demonstrate that they are impacting revenue, whether directly or indirectly, every single week. In March, when Elon Must, via DOGE, demanded that all goverment employees summarize their accomplishments every week via email, he set a conceptual precedent for CEOs expecting the same in a sense. There is no slack in the system for a bad quarter or a learning curve.

Performance Anxiety: In this environment, "good" is no longer good enough. With the candidate pool saturated with highly skilled, unemployed workers, current employees feel an implicit threat: If you don’t deliver, there are 500 people outside waiting to take your seat. This has led to a spike in burnout as workers compete against their own teammates to stay above the cut line. Per the TriNet report, "Burnout is not a new workplace phenomenon, but what is new in 2025 is the widening optimism gap between employers and employees. Leaders believe workloads are largely manageable and that work-life balance is steadily improving. Employees, however—especially Millennials and Gen Z—tell a different story."

Survivor’s Guilt: Some of my clients are feeling a sense of "Survivor’s Guilt." They are relieved to have a paycheck, but demoralized by seeing mentors and friends escorted out of the building. This psychological toll ironically hurts the very productivity companies are trying to boost, as trust in leadership erodes and employees shift from "innovation mode" to "self-preservation mode."

The End of the "Perk Era": A Stark Reality Check

Perhaps the hardest pill for many to swallow is the complete reversal of power dynamics. We have exited the "Golden Age" of tech employment (circa 2012–2022) and entered a new, colder reality. Back in 2024, when asked about whether VMware employee perks would remain, acquiring firm Broadcom's CEO Hock Tan reportedly said "Why would I do any of that? I'm not your dad". Can you imagine someone saying that in 2020??? Gone are the days when companies competed for prospective employees' attention by showering them with signing bonuses, lavish wellness retreats, and "unlimited" everything. In 2025, the balance of power has shifted decisively back to the employer. This transition serves as a brutal reminder of a truth that was easy to ignore when stock prices were soaring and jobs were easy: Your employer is not your friend, especially not in tech.

Despite the years of "we are a family" rhetoric, the employment relationship is more than ever a purely transactional exchange. In this new efficiency-driven market, there is no hesitation for a company to end that transaction the moment the math dictates it. If they can find a slightly cheaper resource, automate a role with AI, or simply distribute your work to two other people to save a salary, they will do so.

This is not malice; it is math. But for employees who bought into the culture of loyalty, it feels like a betrayal. Recognizing this transactional nature is painful, but it is also necessary. It frees you from the illusion of safety and forces you to treat your career like a business of one—where you must constantly protect your own interests, because the "family" you work for certainly won't. You have to look out for yourself because your employer certainly won't.

Future Prospects: The Pivot for 2026

While the data is sobering, the outlook for 2026 is not hopeless—it just requires a pivot. The jobs are there, but they look different than they did in 2021.

Look Outside "Big Tech": The Fortune 500 tech bubble is shrinking, but the "tech-enabled" economy is growing. The Dice Tech Job Report (Dec 2025) noted that while tech sector hiring is volatile, the Manufacturing sector saw 99% year-over-year growth in tech hiring, and Finance/Banking grew by 72%. These traditional industries are desperate for experienced tech leaders to guide their digital transformations.

Highlight "Hands-On" Skills: If you are interviewing, suppress the urge to talk about your management philosophy. Instead, focus on execution. Show how you delivered projects, audited work, or implemented tools yourself.

Re-skill for AI Implementation: Demand for Program Managers who understand how to implement AI workflows is surging. This is a new lane for middle management that adds direct strategic value. Per the Dice report, 53% of U.S. tech job postings now require AI skills, so make sure that's in your resume!

My Conclusion

The "November Shock" of 2025 is a painful reminder that the tech industry is going lean. It won't last forever - we will eventually reach the limits and pendulum-swing back to hiring more aggressively. But in the meantime, the "Great Unbossing" is, while not personal, painful to many; it is a structural correction driven by a ruthless pursuit of efficiency and earnings growth. My investment portfolio is thankful! But I realize those capital gains are coming off the sweat and stress of millions of tech employees.

For my friends in tech—whether you are currently looking for a role or nervously holding onto one—the strategy is the same: Be Adaptable. The era of the "coordinator" is over, and the future belongs to those who can adapt to the new reality and who treat their skills as a product they are selling in a highly competitive market.

Disclaimer: The information provided in this blog post is for educational and informational purposes only and does not constitute specific financial, tax, or legal advice. All investing involves risk, including the potential loss of principal. Market data and statistics cited are believed to be accurate as of the date of publication, but are subject to change. Please consult with a qualified financial professional to discuss your individual circumstances and risk tolerance before making any investment decisions.