Should we be pausing investing right now?

The CNN Money Fear/Greed Indicator

There's a common theme I'm seeing among investors right now: a sense that the market is being overly driven by greed, and thus many sense that it's about to correct downwards. The result is they are hoarding cash. They're not selling out of current investments, just pausing new investments. Whether they realize it or not, they're effectively engaging in market timing as a result.

No doubt, the market has been VERY turbulent since "liberation day" on April 2nd when the tariffs were announced. This spooked the market, and the volatility index (VIX) surged to levels not seen since the pandemic or the 2008 financial crisis. Add to that, the market feels overvalued, with the CAPE ratio only being higher once in its 150-year history, during the dot-com boom in 2000. Then there is persistent inflation, which stands at 2.9%, well above the Fed's target of 2%. The unemployment rate has also been inching up, currently at 4.2%. Given all this, doesn't it make sense to hold back and sit on cash right now, especially for any new savings dollars? Most cash is earning at least 4%, so it's earning a little more than inflation, and that makes it all the easier to hoard cash (CDs, Money Markets, savings, checking, etc.)

I get it. And I feel it in my bones. That gnawing sense that this may be the moment before the market enters a multi-year downturn. It's not the first time I've felt this. I've felt it several times before. And how I responded has almost single-handedly determined my current financial situation.

We all had that same feeling in the dot-com days, that the party couldn't last forever, but with so much excitement, many of us, dare I say, most of us, partied on. When it crashed, we weren't prepared, and many of us panicked. I sold it all back in 2000, and although it wasn't much, I realized I'd been betting with courage I didn't actually have, writing proverbial "checks I wasn't prepared to cash". I knew I was supposed to hold for the long term, but I couldn't reconcile my brain with my heart. It took me a few years to recover, and I vowed that the next time would be different. When the financial crisis hit in 2007, then again in 2008, I held firm and continued saving, investing, and rebalancing religiously. And I did the same during the pandemic. Each time, it was with a pit in my stomach that I kept buying stocks, thinking, "How much lower can this possibly go? I must be crazy to keep investing." At the time, I did it on blind faith. However, the discipline of investing during those dark days is what substantially fueled my early retirement 15 years later.

Buffett notably said, "Investing is more about emotional discipline than raw smarts—always keep your ego in check." Sometimes our ego tells us to sell. Sometimes it tells us to buy. Mostly, it tells us that we know what to do because we're smarter than everyone else. And mostly it's wrong.

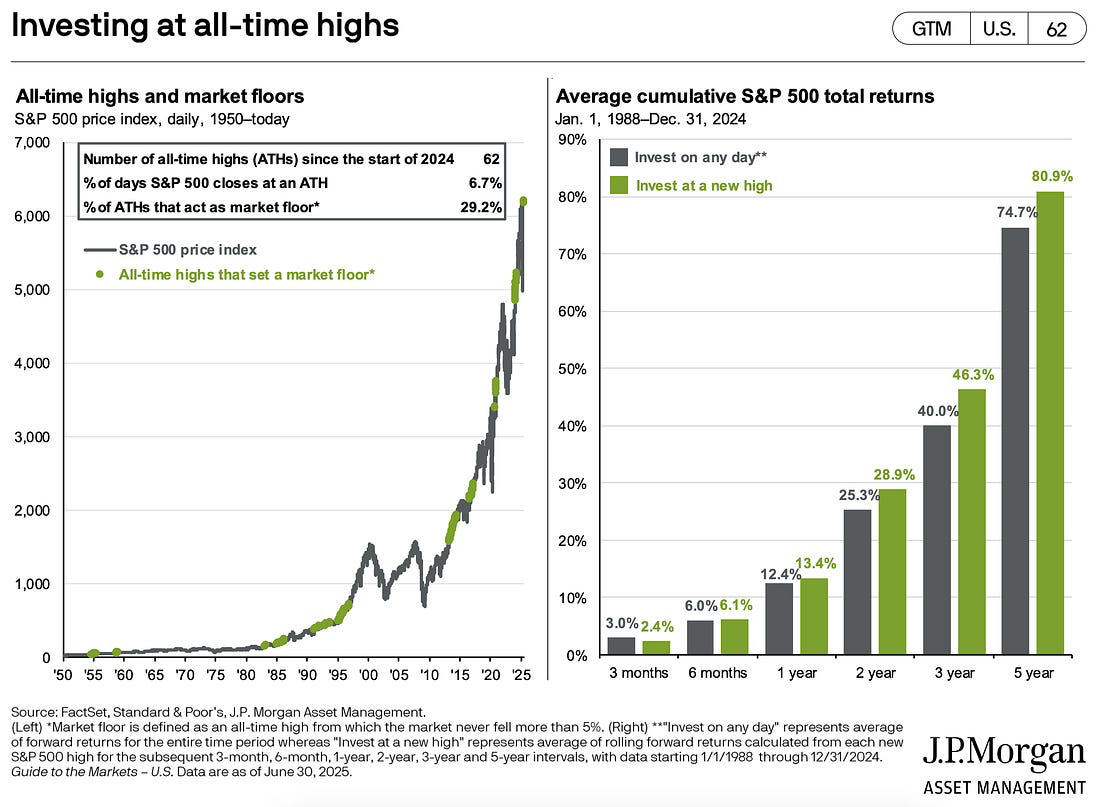

We are in one of those moments right now, and it may get worse. I have no idea what the market will do in the coming year. But for money we plan to use in retirement 10-40 years from now, it makes sense to hold our noses, close our eyes, and invest regardless of what we think might happen next month. Unless one needs the money sooner, think of it as the possibility that stocks may go on sale. That's not so bad, right? I understand that there's always some hesitation about entering the market, especially in times like these. However, if we're investing for the long haul, then even starting at the top of the market still provides benefits compared to trying to time the market.

JP Morgan put numbers on this concept. They found that investing during all-time highs tends to yield better long-term outcomes than investing on any other days. What??? 🤯 This is completely counterintuitive because one would think that investing during a market high is a bad idea, right? Aren't we supposed to buy low, sell high? However, their paper demonstrates that more market highs often follow previous market highs, so given the choice, you're statistically better off investing during market highs than on any average day.

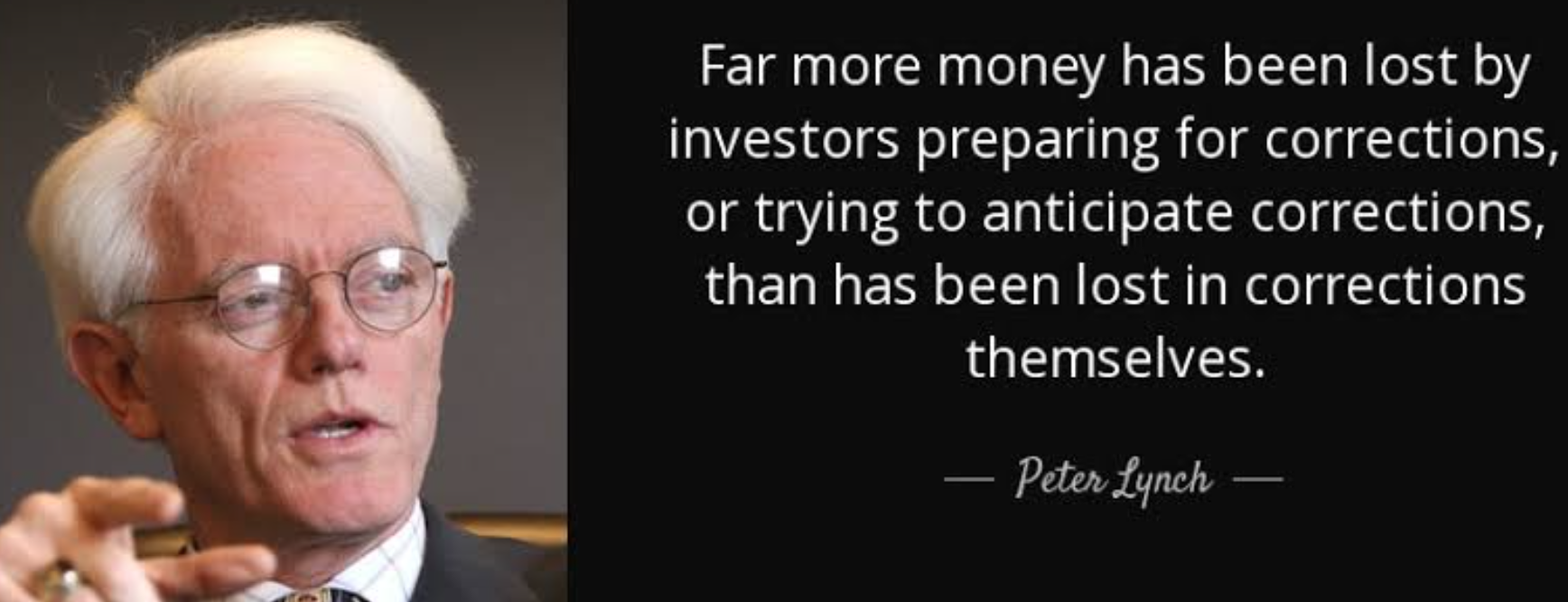

| The investing guru Peter Lynch was well aware of this.

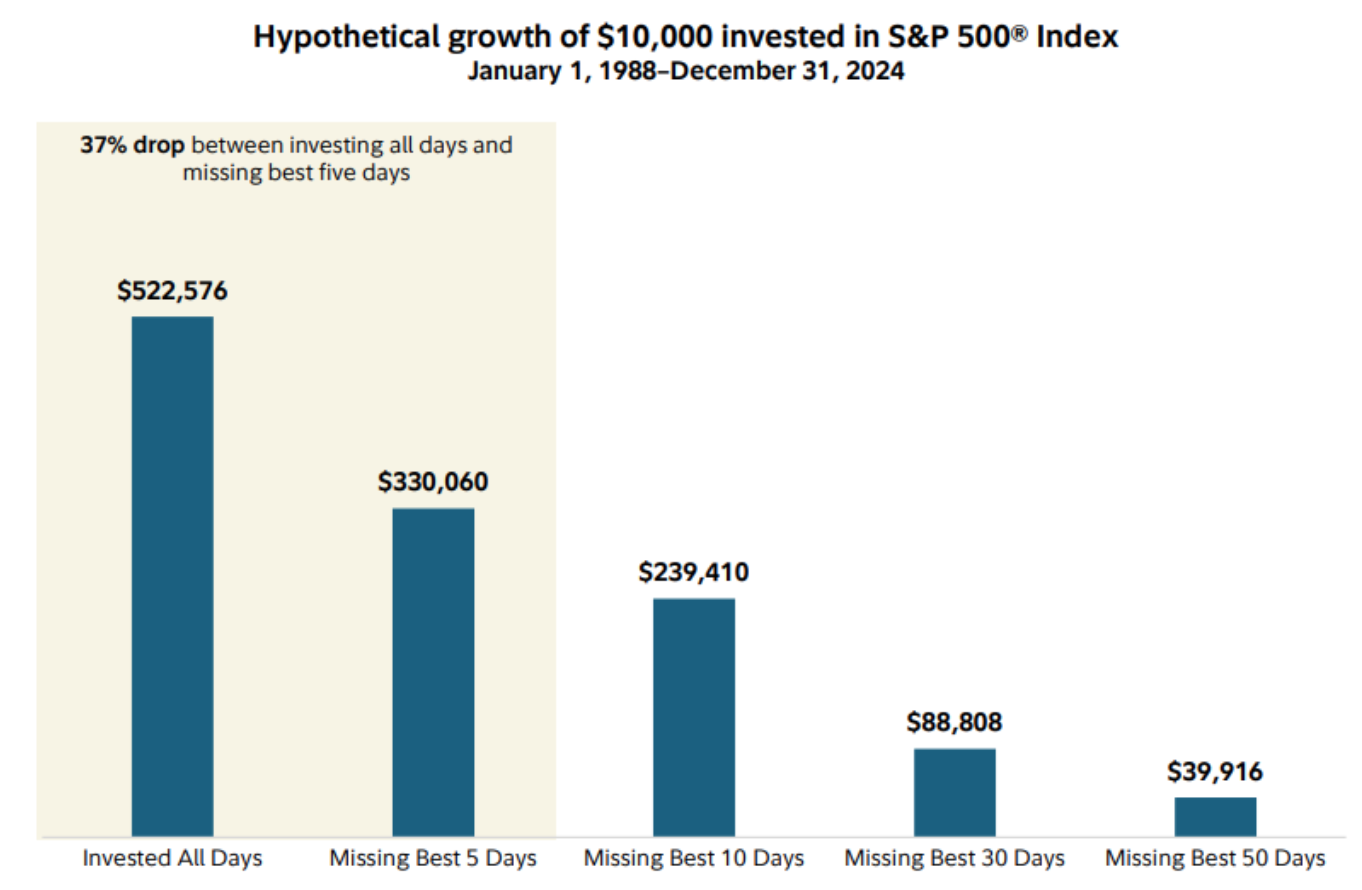

Fidelity recently published the following chart, which illustrates the challenges of market timing. If you missed only the five best days, due to market timing, over 36 years, you'd have roughly a third less money than if you'd just stayed invested through thick and thin. Stop and think about that for a moment.

Fidelity: Three Reasons to Stay Invested Right Now

The point is that it's impossible to know what those five days are in advance. It might be tomorrow. It might be next month. The cost of missing those days is far higher than the cost of living through the down days. Remember, it's easy to hold off investing until tomorrow. It's hard to decide "today is the day". We all exhibit some amount of Status Quo Bias, where faced with uncertainty, we default to doing nothing—even if inaction isn’t the best strategy—because maintaining the current state feels safer than risking a change.

Even though we may feel like the market is about to correct downwards, waiting until it actually happens is more detrimental to our long-term retirement portfolios than simply investing anyway and riding out the consequences. If you're one of the people in that boat, I hope this has been helpful. If you want to read more about this, Sam Ro has a great blog post about it.

Stay rational my friends.

Disclaimer: The information provided here is for general educational purposes only and should not be construed as personalized financial, legal, or benefits advice. Individual circumstances vary and outcomes may differ. Readers should consult a qualified professional before making decisions. Prospero Wealth, LLC, is a registered investment advisor offering advisory services in the states of Washington, Oregon, California, and in other jurisdictions where exempted.