Open Enrollment at F5

I was sorry to hear about the RIF last week. I hope you weren't affected. If you're still there, it's open enrollment season so you have some decisions to make. As many of my clients are F5 employees, I reviewed the 2025-2026 benefits document, and I have some insights to share. Although the plan remains largely unchanged, there are a few important updates to be aware of, and it’s worth revisiting your elections before the open enrollment deadline closes.

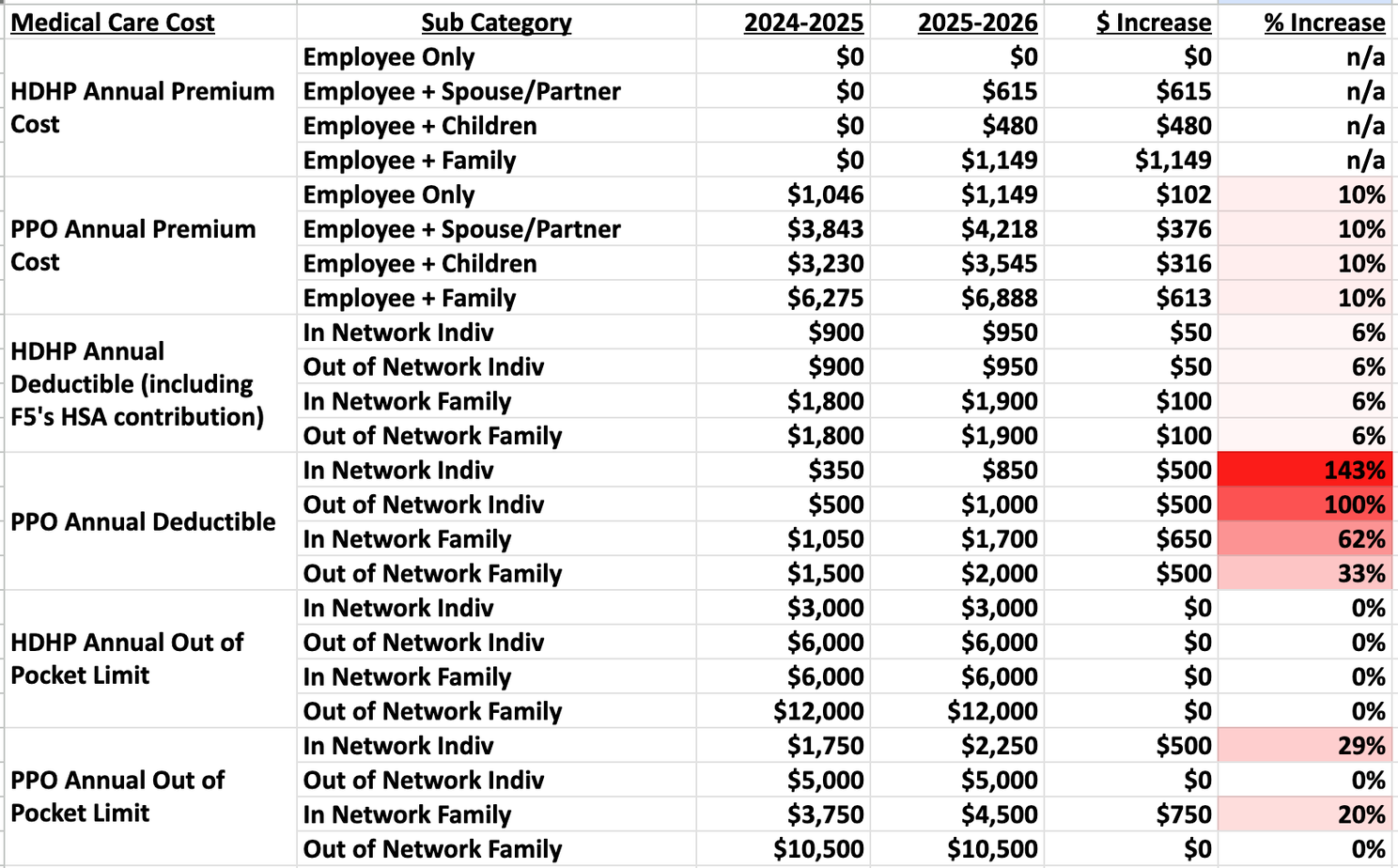

1. Medical insurance costs increased for both the HDHP and PPO programs (see the chart below). Healthcare insurance premiums are increasing rapidly everywhere, and F5’s Premera Blue Cross insurance is no different. You can see the cost changes in the first tab of my google sheet. PPO premiums went up 10%. They started charging premiums for HDHP spouse/children/family plans. The deductibles increased slightly for HDHP and substantially for PPO.

F5's medical insurance plan premiums, deductibles and out of pocket limits went up this year.

2. F5 added a health reimbursement arrangement (HRA) through Garner. This is something you can choose to take advantage of with both the HDHP and PPO insurance plans, once you’ve enrolled. Garner will reimburse up to $1,000 individual / $2,000 family in eligible out-of-pocket costs when you use one of their recommended providers. HDHP members must first meet the IRS minimum deductible ($1,650/$3,300) before Garner will reimburse them. F5’s goal in offering this is to lower insurance costs by incentivizing employees to use in-network providers who (based on the data) seem to resolve medical issues more cost-effectively. The savings come from Garner recommending a subset of in-network doctors whose patients (based on the data) have fewer complications, less unnecessary care, and lower total episode-of-care costs. Some users have expressed concerns about Garner, mainly that reimbursement claims are often rejected, and the list of recommended doctors is outdated (many are no longer accepting new patients or are no longer practicing). Caveat emptor.

Other than that, I didn’t see any significant plan-design changes in the life insurance, disability insurance, ESPP, or 401(k) programs. That's good because F5 has great benefits and covers much of the cost.

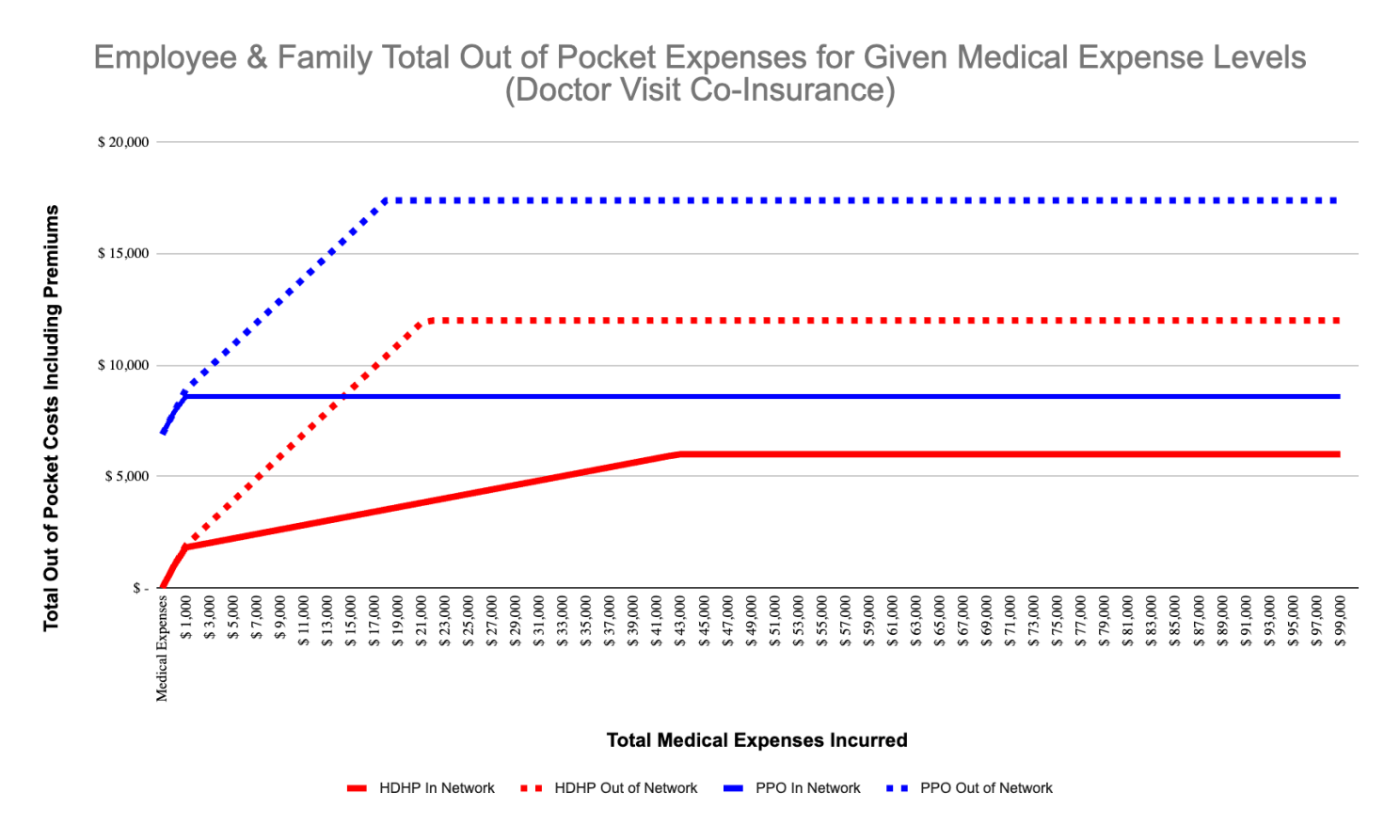

The key decision most employees need to make is whether to elect the HDHP or PPO medical insurance. I ran the numbers for every combination of employee, employee+partner, employee+children and family. I also used two simplifying assumptions: your expenses are either 100% office visits or 100% hospital expenses. The spreadsheet has it all, and may be helpful as you make a decision. Remember, the providers you can access, and the care provided is the same under both policies. It's only about the premium cost, co-insurance, deductibles and maximum out-of-pocket amounts. In my opinion, this is very much a data-driven decision:

F5 incurs lower overall costs when employees use the HDHP program, and as such they incentivize employees to choose this over the PPO program.

The HDHP comes with access to a Health Savings Account, which is a triple tax-free savings strategy if you use it as a long-term medical expense savings account (rather than for current medical expenses). Beware that the IRS HSA limits apply on an annual basis, and don’t line up with F5’s Oct-1 to Sept-30 fiscal benefits year. Determining how much to contribute takes some math. Also, remember that F5’s HSA contributions are included in the IRS limits (They contribute $750 indiv / $1,500 family per year).

In-Network providers always cost less out-of-pocket than Out-of-Network providers in F5’s Premera Blue Cross plan. Where possible, stick with in-network providers.

If you use in-network providers and most or all of your medical expenses are likely to be office visits, then cost of HDHP is lower than PPO in most cases.

If you use in-network providers and most or all of your medical expenses are likely to be hospital visits, then no matter how much medical expense you incur, your total out-of-pocket expense is lower using the HDHP plan.

If you must use out-of-network providers, then the decision is clearly in favor of the HDHP. Refer to the attached charts (dotted lines only) to decide what makes the most sense for you.

Below is an example of one of the charts in the google sheet:

For Family coverage (employee + partner/spouse + 1 or more children), the overall costs are lower, given any level of office visit medical expenses) using the HDHP medical insurance program.

Several simplifying assumptions had to be made in these charts, so these numbers cannot represent your actual out-of-pocket expenses, obviously. The charts use simplified data to get an idea of what the expenses could be given certain narrow scenarios. The key assumption is the co-insurance percentage, which depends on the type of medical service received. These charts assume that only a single type of medical service was received all year (either hospital visits or doctor’s office visits).

I hope this was helpful to you. If so, please let me know if the comments!

Disclaimer: The information provided in this blog post is for educational and informational purposes only and does not constitute specific financial, tax, or legal advice. All investing involves risk, including the potential loss of principal. Market data and statistics cited are believed to be accurate as of the date of publication, but are subject to change. Please consult with a qualified financial professional to discuss your individual circumstances and risk tolerance before making any investment decisions.