My Services

-

I’ll assess your current financial situation and determine when you could safely retire, take a sabbatical, go part-time, or pivot to a second act.

-

I’ll develop a custom strategy using various techniques to minimize your income and capital gains taxes

-

This is not a one-time conversation. I’ll guide you, step by step, as you implement your plan

-

Earning money is the hardest part of saving. I can help you navigate your career in tech, to optimize your pay and job satisfaction

-

By managing your investments for you, you’re freed up to spend time on other, more important things while knowing your assets are being taken care of

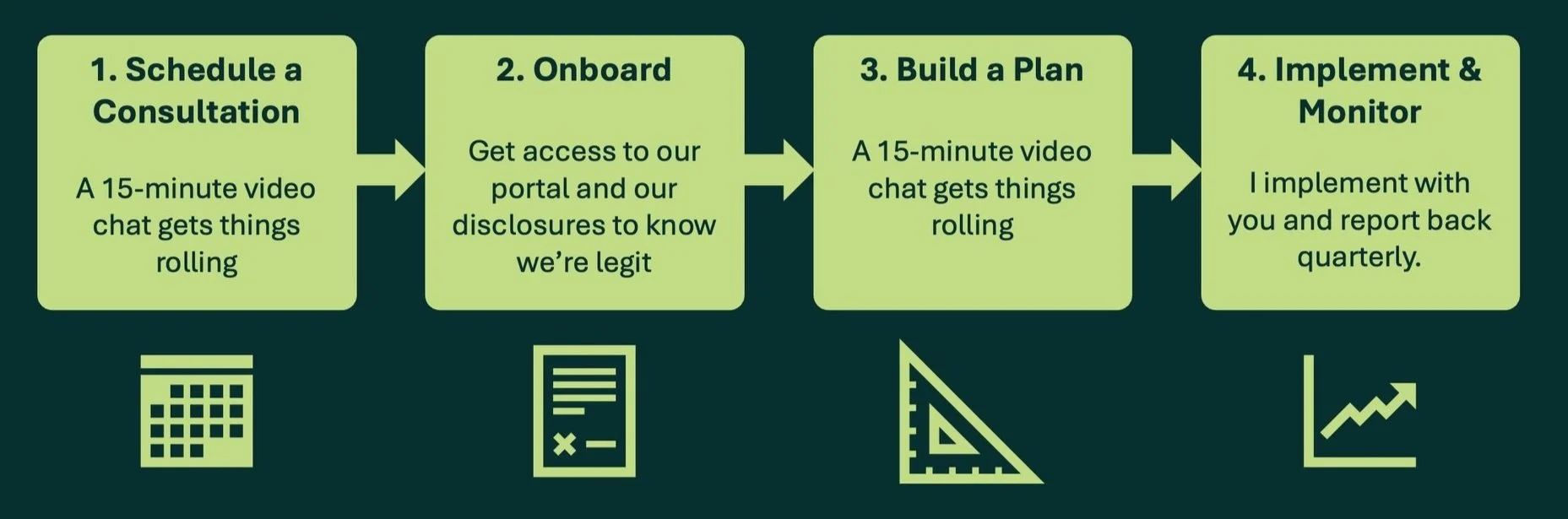

My Process

-

The first step is to create a financial plan. It serves as the foundation and roadmap for everything we do going forward. Typically, this takes 1-2 months, and we build it via an online tool that you’ll have access to.

-

Developing a great plan doesn’t mean much if it’s not implemented and maintained. In addition to planning, I can manage your investments. Most of my clients choose to outsource this work because it frees them up to focus on more important things.

I take a passive, fee-conscious approach that ensures your portfolio remains diversified, low-cost, and properly aligned with your risk tolerance and financial profile. When appropriate, we can use a number of solutions to minimize future capital gains taxes, such as mega-backdoor Roths, Direct Indexing, Tax-Aware Long/Short solutions and Variable Prepaid Forwards.

I actively manage your portfolio through monitoring and rebalancing to stick to your asset allocation plan.

-

After implementing your plan, I also support you as needed, in areas such as:

Income and career: Raises, promotions, equity, and job offer decisions

Employee benefits: Optimize health, insurance, equity, and retirement benefits

Cash-flow planning: Tracking spending, automation of savings, funding your priorities

Tax planning: Minimizing taxes, harvesting of losses, proactively planning ahead

Investing: Optimization of portfolios, reduction of fees, evaluation of alternative options like real estate

Retirement readiness: Defining goals, targeting a retirement date, planning income and expenses

Major life decisions: Relocating, college planning, charitable giving

Estate planning: Coordination of wills, trusts, and account beneficiaries

-

I’m here when you need me, for whatever you need help with. Got a new job offer? Seeking to lower insurance costs? Worried about the market? Let’s chat.

I proactively remind you when it’s time to do something we’ve previously planned.

You'll also have continuous access to your personal finance portal through Prospero’s RightCapital.

Examples of the kinds of topics we’ll address together:

-

I pay a lot in taxes. How can I lower that?

Are there any tax saving opportunities I'm not aware of?

Am I taking full advantage of all the benefits my company offers?

Did I claim the correct basis on my RSUs, or am I overpaying my taxes?

I made some painful tax mistakes last year. How do I avoid that going forward?

How can I be charitable in a tax-efficient way?

-

How should I invest in my portfolio?

Should I hold or sell my RSU/ESPP/Options shares? What are the tax implications?

I have some highly-appreciated shares from my employer. What should I do with them?

My company will have a liquidity event soon. How should I prepare for the tax implications?

I have other investments, so how should I optimize my overall portfolio?

I own some rental properties. Should I continue or explore other investment options?

Should I invest in crypto currency?

What should I do in response to the latest market drop?

-

How should I invest my 401(k) or Health Savings Account?

Which should I choose, my company's 401(k) or their Roth 401(k)?

I'm maxing out my 401(k) but could save more. What are my options?

I've heard about the Backdoor Roth and the Mega-Backdoor Roth. Should I do one of those?

I save every month, but I'm still not sure where I'll end up come retirement. Can we map that out?

Should I pay off my mortgage early?

-

How can I protect myself in case I get impacted by the next RIF?

How much should I keep in my emergency funds?

I want to diversify from my employer stock but don't want a big tax bill next April. What are my options?

Will my family be okay financially if something happens to me?

Do I have enough insurance? Am I paying too much for it?

-

How can I negotiate for a better salary?

Is it time to change jobs or switch companies?

I want to change careers someday. What can I do now to prepare for that?

I'm interested in early retirement / F.I.R.E. How can I make that work? How soon? What do I have to do to get there?

-

Am I saving enough to hit my retirement goals?

When could I retire?

Could I retire early?

How much can I spend if I retire in X years?

What should my retirement goals be?

-

What health insurance plan should I choose?

My employer offers a choice of HDHP or PPO. Which should I choose?

How should I handle health insurance between retirement and Medicare eligibility?

-

How can I take better advantage of the benefits my company offers?

Should I choose the 401(k) or Roth 401(k) option?

Should I use a Mega Backdoor Roth 401(k)?

-

How should I plan for my kid's college expenses?

What should I be thinking about for my estate plan?